So as I mentioned a couple days ago, I’ve been playing with the Apple’s Cards App on my iPhone 4S and have been mostly satisfied with the experience so far, but I hit into a couple hitches today.

The first thing I noticed was the server was overloaded this afternoon. Half the time, I would get an alert telling me there was a problem connecting to the server and to try again later. But if I tap Buy again, it usually went through.

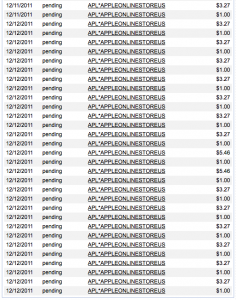

Then I got to a point where my card was being declined. I logged into my credit card’s website and looked at the pending transactions:

No, I didn’t create that many cards. Half of them are $1 authorizations. Of the remaining half, about 1/3 are duplicates from server failures, which I’m hoping I won’t be charged as these duplicate orders don’t show up under my account. The cards are $2.99 each + tax. If you want to deliver them internationally, it’s $4.99 + tax.

So I expected a call from my credit card fraud/security team, but that call never came. I eventually called customer support myself assuming that the flood of Apple transactions was the cause of my card being declined. After speaking with someone on the security team, it turns out there’s a limit of 25 transactions per day before my card starts rejecting additional charges. And each of those $1 authorizations count toward that limit.

Here’s my suggestion to Apple: Please group multiple card orders like you group iTunes purchases and make one charge at the end of the day. Given it’s the holiday season, the perfect time for someone to use your Cards app, sending out 13+ cards should not be uncommon and that assume I won’t be using the credit card anywhere else that day. Plus with your server issues, some charges are showing up twice. If needed, I can even create all the cards I want beforehand and then submit them all to be charged together, but that’s currently not an option via your app. This would not only avoid having so many transactions which would easily trigger fraud alerts, but you wouldn’t have to make so many separate authorization checks. Plus it’s better for you in the long run too, since you’ll be saving on per transaction credit card fees.

I’ve already submitted the same feedback at Apple – Cards – Feedback. Hopefully we’ll see this fixed soon before the holidays are over.